Venture’s Role: A Power Law Economy…and Society

An established rule that governs venture investing has become more prevalent in the wider economy, with broad societal ramifications.

It is well-established orthodoxy that venture capital investments follow a power law distribution. In the context of VC, this means that the top performer in a given market or portfolio is as valuable as the next 9 best performers combined. The top 1% account for 10% of total returns and the top 10%, in turn, basically capture all the value.

In short hand (at exit/IPO): 1 Facebook is equal to 9 Groupons, together equal to 90 Pandoras. A whole lot more is written online on the subject but the clearest illustration comes from this CB Insights chart covering 6 years of exits. Most venture capitalists form their investment strategies with the acceptance of power laws as ground truth.

But, while a lot of effort has gone into describing venture investing power laws in action, not a lot of discourse covers what preconditions must exist in order for power law distributions to take hold. Nor is discussed what broader ramifications nearly ubiquitous power law-based investment strategies portend.

In fact, the field of network science, dating back to Euler’s 1736 Seven Bridges of Königsberg and experiencing a rapid resurgence in academic influence since the 1980s, offers plenty of research into the preconditions and after effects of power laws. I became somewhat familiar through reading Niall Ferguson’s The Square and the Tower, but am no expert, and could never adequately explain this rapidly evolving field with far reaching implications for statistics, finance, genomics, epidemiology, particle physics, and more.

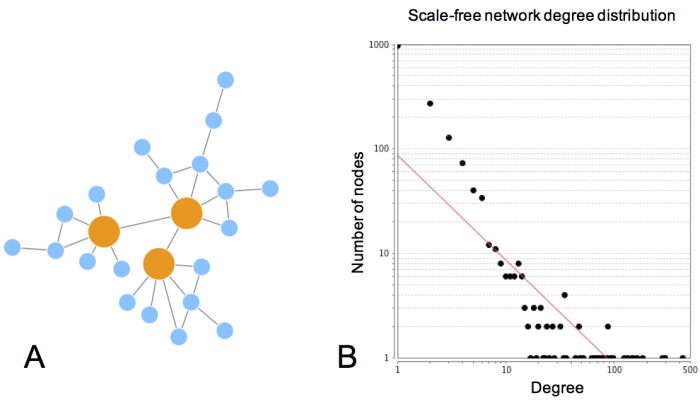

However, I would like to hone in on the accepted prerequisite of power law (aka Pareto) distributions: they appear only in ‘scale-free’ networks. Scale-free networks, it should come as no surprise, can grow very large. This is because of what’s known as their ‘fault tolerance.’ But the two defining characteristics of a scale-free network are these:

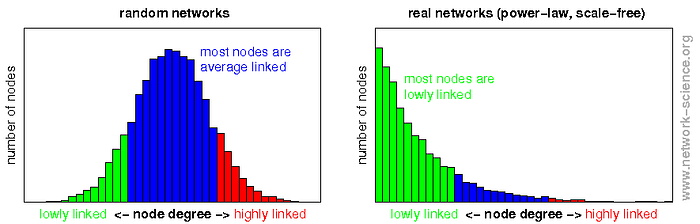

1. Most nodes in the network have very few links to other nodes.

2. A small number of nodes, known as hubs, are hyper-connected to many other nodes.

This is in sharp contrast to a normal distribution (aka Gaussian aka The Bell Curve) where most nodes tend to the same average level of connectedness:

These power laws are now appearing in more and more places. The (ICT) ‘tech’ winners that drove power law venture returns have now become the drivers of growth in our public markets and overall economy. And they have taken their scale-free networks with them.

They now include the 5 largest companies in the world, who themselves rather famously became as valuable as the bottom 282 companies in the S&P combined. Public market investors have their own term for this increased influence, The Great Narrowing.

Most other industries have taken notice too, deploying versions of the higher concentration playbook around the world.

And beyond the capital markets, practitioners in many fields, from human resources to Brazilian football matches, are speaking in the language of power laws. It very quickly begins to sound rather ominous and Nietzschean:

These “hyper performers” are people you want to attract, retain, and empower. These are the people who start companies, develop new products, create amazing advertising copy, write award winning books and articles, or set an example for your sales force. They are often gifted in a certain way… and drive orders of magnitude more value than many of their peers.

— Josh Bersin, Forbes Contributor

So what are the implications for a society governed by power laws and not bell curves? A society where, to borrow the terminology of network science, we have very many nodes with only a few links and very few hubs with a large number of links. A society of many individuals and few communities. Infinite scale but low connectedness.

Well, we’re seeing it all around us. Industry is less competitive. Increased concentration of wealth and levels inequality have led to populist uprisings from across the political spectrum all over the world. People show fealty (links) to a few global platforms (hubs) but are more siloed, more lonely, and less connected to meaningful communities of their peers.

And, to be clear, the venture capital industry bears some responsibility, by pushing ‘winner-take-all’ power law strategies on startups and, thus, into the broader cultural zeitgeist.

Peter Thiel notoriously advises students (ie not even founders yet, without existing businesses or even business plans), “If you’re starting a company, you always want to aim for monopoly and you always want to avoid competition.” He wrote an entire book about it that Forbes called perhaps the once-in-a-generation “book that really has the power to transform the world.”

That assessment rings true, though perhaps not in the glowing way it was intended. Really, what could be more un-American as an ex ante founding principle than to avoid competition at all cost? It seems the future Thiel would like to see looks more like Venezuela or Angola than the United States.

A better vision involves more competition and more connectedness. A system with lots of conductivity, among nodes that tend toward an average level of linked-ness. Nodes that interact on closer to a ‘level playing field.’

And this is the last key lesson of power law distributions:

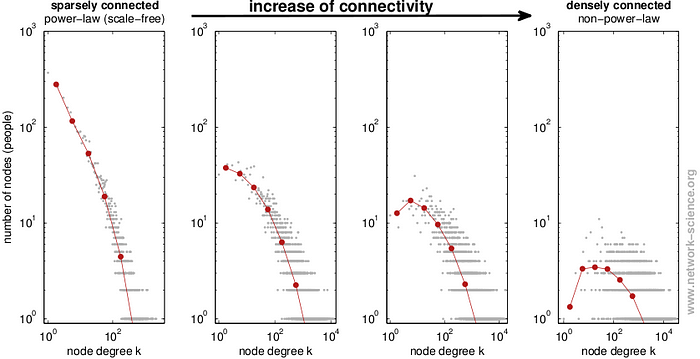

Increases in connectivity within a network lead to greater divergence from a power law distribution.

As a network goes from sparsely connected to densely connected, power law distributions begin to fade and normal distributions start to emerge. Building more densely connected networks may take longer, they may not be ‘scale-free,’ but they offer a more lasting and stable system.

And so, back to the VC corner of the world, the once widely accepted frameworks and strategies in startup financing are beginning to shift. Investors, along with the founders they back, are waking up to the limits of a monolithic ‘winner-take-all’ mentality. Albert Wenger & USV, holders of some of the more sophisticated understandings of scarcity, abundance, and network effects, have themselves begun to identify and articulate changes in this landscape:

But founders are the customers of VC money and meaningful change will have to cater to their tastes and demands. The current capital abundant environment, in which skilled entrepreneurs now regularly choose between multiple term sheets, affords a lot bargaining power to do so.

You hear founders talking about not wanting to get on the ‘treadmill of traditional VC’ at all. The idea has gone mainstream enough for the New York Times to hand it a Sunday edition profile (which itself reached #1 on Hacker News).

One firm, indie.vc, is in the midst of a roadshow spreading the gospel of alternative funding models. Described as distinctly different from the one-size-fits-all venture model, they claim that their terms are flexible enough to capture a wider range of investor and entrepreneur-friendly outcomes. They are not alone: Lighter Capital, RAC, venture debt groups like WTI, and banks like SVB are all exploring new paths with similar goals in mind.

All told, most of the internet products we use, while aiming (or claiming) to create a more connected world have, in fact, done far more to separate us than to connect us. Their ‘scale-free’ networks are characterized by many nodes, few hubs, and sparse overall connectivity. The way VCs financed the companies that created these products itself played a large role.

This is not to say that investors should no longer back risky ideas with the potential for world-changing outcomes and out-sized returns. But power laws are not the a priori natural state of being, in venture capital or anywhere else. The industry needs to wake up to this fact and find better, less constrictive ways to fund innovation going forward. New models that A) allow for a wider range of outcomes for founders and B) orient around building more densely connected networks are a step in the right direction.

p.s. Attention New Yorkers, Bryce and the Indie VC team will be at Company on Friday, Feb 8th and I’m excited to join that conversation.